Legal malpractice is priced using what’s called a step rating methodology. But what exactly does that mean? Watch this video to learn more, or continue reading below.

Envision your career as a step ladder. When you’re a young lawyer, you’re on the first rung of the ladder. You’re starting to acquire work and your coverage is just starting, too. Your exposure is small because you haven’t done much legal work yet. Because of this, your first year’s premium is substantially reduced. This is called step 1.

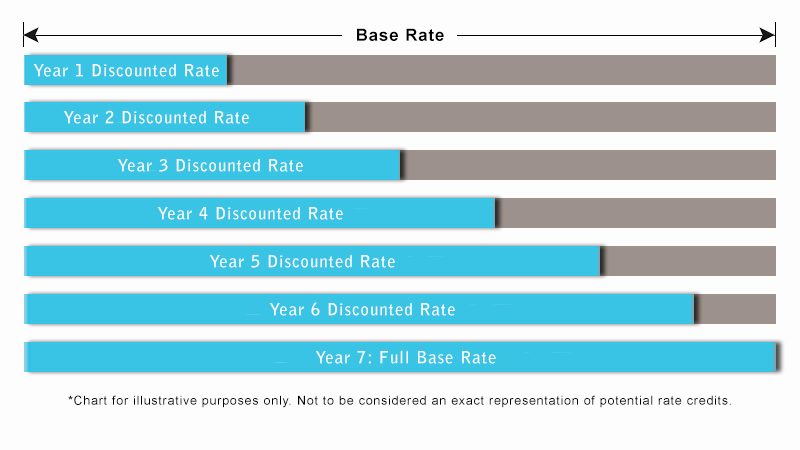

From then on, the amount of work you’ve done since the start date of your first policy continues to grow. You likely have more clients and cases, which means you also have more exposure. On the ladder, you’re moving up one step each year. Your premium goes up a little bit each year, too, in order to cover the year ahead, as well as the years behind you.

When you reach step 7, you’re at the top of the ladder. You’ve now met the full mature rate for your legal malpractice insurance. This means your premiums will level off, subject to any overall rate increase or decrease. So, why does it take 7 years? Different insurance carriers or lines of insurance have various timelines for reaching maturity, based on claims data and other forms of analysis.

At OAMIC, our data shows that policies reach maturity at the 7-year mark. This means the likelihood of a potential claim arising from services rendered in earlier years lessens. This 7-year period also allows for a much more gradual, manageable premium increase for our insureds.

FREQUENTLY ASKED QUESTIONS ABOUT STEP RATES:

Why is it priced this way?

As you may know, legal malpractice is a claims-made policy. This means that you need to be insured on both the date of the incident itself AND the date the claim is reported. Therefore, when you purchase a policy it covers you for the year ahead, as well as all the years back to your retroactive date, which is the start date of your first policy. (Learn more about claims-made policies here.)

There is usually a delay between when an incident happens and when it is discovered and reported. Because of this, an attorney has less risk of a claim during their early years of coverage. As the years go on, an attorney accrues more and more risk. Therefore, your premium starts smaller and gets larger until it reaches maturity.

How much will my premium increase each year?

The step rate credit decreases each year until maturity, meaning your premium will likely go up. However, your premium increase may vary based on other underwriting factors, such as your claim experience, a change in the limits and deductible purchased, or a change in the overall base rate.

Attorneys will have a retroactive date, also called a prior acts date, associated with their coverage. This is the date stated in the Policy that limits coverage to acts or omissions occurring on or after the stated date. This is particularly important since legal malpractice insurance is a claims-made policy.

Please feel free to contact us if you have additional questions about this topic.