When a lawyer leaves a firm we insure, we typically get questions about what to do with regard to the lawyers professional liability insurance (LPL). For the firm they’re leaving, it can be as simple as completing the supplemental application to remove the lawyer from the existing policy. For the lawyer leaving, however, it can be a little more complicated.

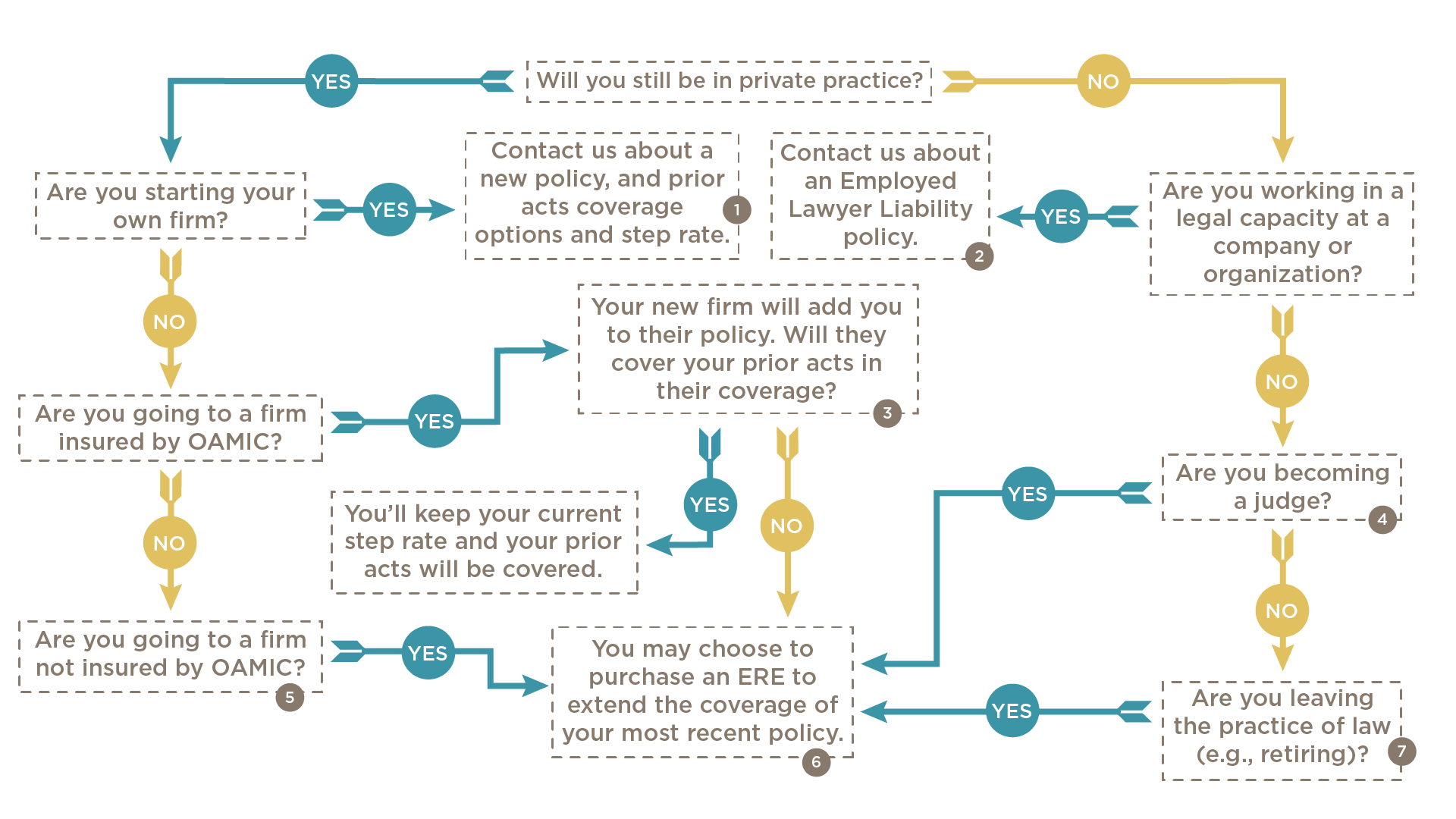

Whether you’re changing firms, starting your own firm or getting ready for retirement, OAMIC can help you find the options that best fit your needs. Because most of your options depend on what you’ll be doing once you leave your current OAMIC-insured firm, we’ve provided a flowchart to better illustrate what matters you’ll want to consider. Some boxes may have terms or variables you should know, so we’ve detailed those out below.

Definitions and Variables

- When establishing a new policy for a new firm, you may have the option to keep your existing step rating and include your prior acts (if you were previously covered by OAMIC), or you may choose to start your coverage at the time your firm is established. Step rates do not reflect how long you’ve been practicing, only how long you’ve been continuously covered by OAMIC. We also have other insurance products, like office packages, to help ensure your firm and your assets are protected.

- Employed lawyer liability policies can cover those not in private practice but employed by companies and organizations (g., as in-house counsel). Learn more about employed lawyer liability policies.

- Your new firm will need to complete the supplemental application to add you to their existing policy. If it has not yet been specified, you will want to ask if your new firm’s policy will be covering your prior acts in their coverage. A typical policy may only provide coverage for claims made while the attorney is a member of said law firm. If the new firm’s policy does not extend coverage for acts prior to the attorney joining the new firm, you may want to look into an ERE.

- If you are becoming a judge and will not be working for clients as an attorney, then answer ‘yes.’ If you will still be doing work for clients independently, contact us for a quote on an individual policy to make sure you are fully protected.

- If your new firm is located in Oklahoma and is interested in LPL options, OAMIC offers competitive rates and local, unmatched customer service. Contact us for a quote or if we can answer any questions.

- An extended reporting endorsement (ERE, also known as tail coverage) may be needed because of the claims-made nature of LPL. It extends the terms and conditions of the prior existing policy and allows an additional period of time in which a claim may be reported. Learn more about EREs and how they work.

- If you are retiring from a firm and will not be working for clients as an attorney, then answer ‘yes.’ If you will still be doing work for clients independently, contact us for a quote on an individual policy to make sure you are fully protected.

Related Articles

Get a Quote

Apply for professional liability coverage today through our convenient online portal. In most cases, you will receive a quote within 24 hours.